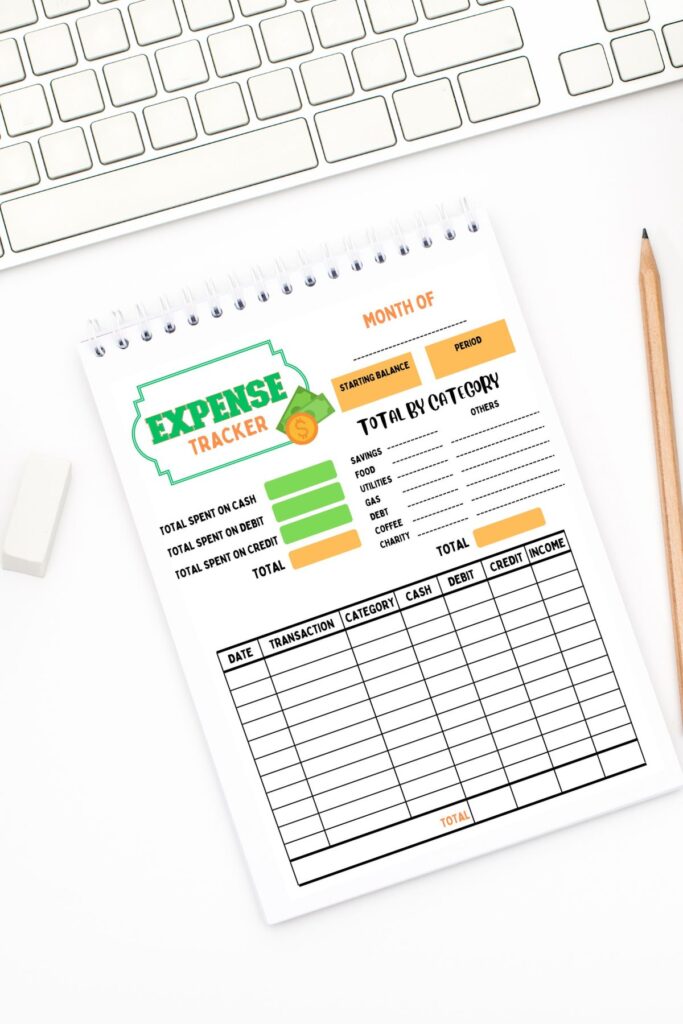

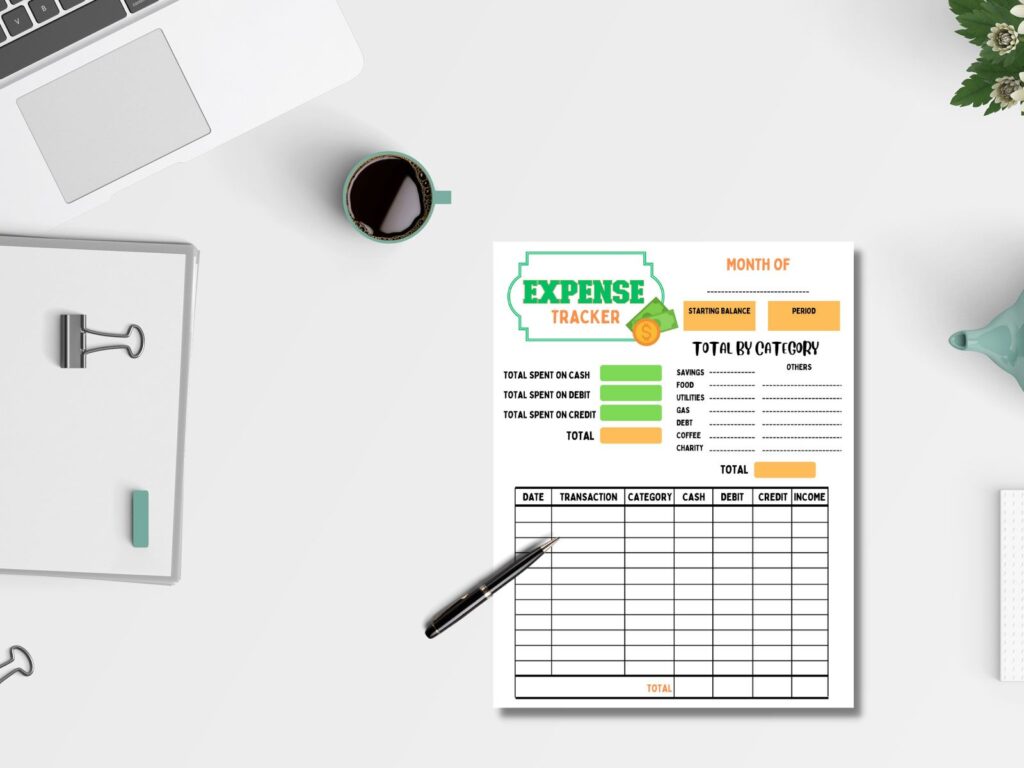

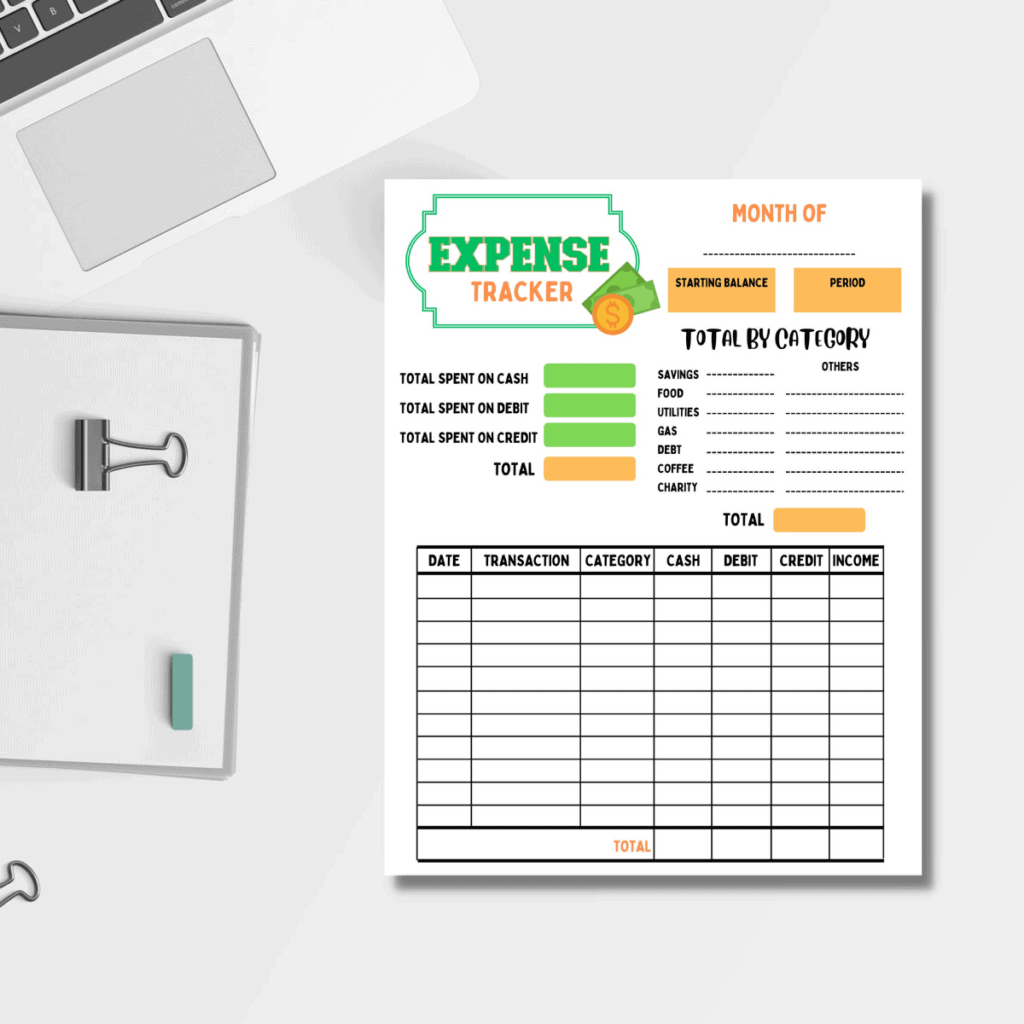

A free printable expense tracker is the first step you need to do to be able to reach your savings goal. This is an essential tool to keep track of all your expenses on a monthly basis. A free tool like this is a good way to start doing your daily spending log if it’s your first time. Don’t wait for your bank account to be empty before you start a budgeting plan!

WHY SET FINANCIAL GOALS?

Setting financial goal are an important thing. It gives you a sense of direction, giving you an idea of how to save money and manage your spending habits. Because you are aware of the goal you are aiming for, they make it simpler for you to make sacrifices or keep to a spending plan. They assist you in maintaining long-term focus. Having a free printable expense tracker template is the best way for you to have control of your finances.

You can maintain discipline in your investing method by establishing financial goals, which give you vision and energy. Your objectives should be significant to you so that they can motivate you to continue pursuing them. A lot of us aspire to have financial freedom, but getting there can be a challenging task.

Setting goals and rules are a great way to get out of a bad financial situation. One of the best things that I recommend you trying is the 80/20 rule. The 80 – 20 budget plan simply focuses on the significance of saving money and paying oneself initially.

Being held responsible for what you do and learning to write down your objectives will help to keep you accurate about your progress. You can stay on track by analyzing your goals frequently. Upon achieving your financial objectives, you will feel accomplished. Celebrating important achievements can help keep you motivated to commit to your goals.

HOW TO IMPROVE FINANCIAL HABITS?

For many people, it is crucial that they have sufficient cash on hand, investments, and savings to support the lifestyle they want for themselves and their families. You absolutely must improve your financial habits in order to do that. Lucky for you, I made a list of some of the things you can do to attain that:

INVEST

Bad markets in the stock market can cause individuals to wonder whether investing is a good idea, but traditionally there hasn’t been a greater means of building your wealth. Your funds will increase dramatically thanks to the magic of compound interest alone, yet it will take a long time to see real growth.

CREDIT SCORE

Credit score is a crucial factor in determining the interest rate you are given when funding a home or a new car. It also affects how much you pay for a variety of other necessities, such as life insurance premiums and auto insurance. Credit scores are so important because it’s assumed that those who have careless financial habits will also have reckless behavior in other areas of their life.

LIVE BELOW YOUR MEANS

Learning to live frugally requires cultivating a mindset concentrating on getting by with less, but it’s simpler than you might assume. In fact, many rich folks formed the lifestyle of living within their means before becoming affluent. Adopting a frugal life is not difficult. It simply entails becoming more adept at differentiating between necessities and wants.

MONEY LIFE HACKS

Read books and gather all the information you can to help you with this journey. Being knowledgeable about it is a great advantage. Visit blogs as well that you think might give you more understanding. There are lots of hacks that you can try for yourself. Don’t be afraid to explore.

PAY CREDITS IN FULL

The process of accumulating wealth is tainted by high-interest loans and credit cards. Make it a habit to pay off the entire balance every month. Having paid off student loans, mortgages, and other similar loans is not urgent because their interest rates are typically much lower. Even so, timely payment of these loans with lower interest rates is crucial because it will raise one’s credit score.

TYPES OF EXPENSES

With all the monthly expenses and monthly bills, it can be really hard to keep track of everything. Receiving a credit card statement is one of the most stressful things for most people. This is why categorizing expenses is a good idea and should be practiced. This will make you more aware of all your fees and spending. Take advantage of this free expense tracker printable.

You will be surprised of how much money you can still save at the end of the month if you itemize your expenses. To give you an idea of what type of expense to put under your budget spreadsheet, here is a list of different categories to keep in mind:

Personal

Other than tuition and fees, room and board, books and supplies, and transportation, personal expenses include anything else you might spend money on yourself. Personal expenditures cover a variety of basic essentials like laundry, mobile phone service, clothes and shoes, items for personal hygiene, prescription medications, leisure activities, and also more.

When planning your personal budget, keep in mind that costs will change depending on where you live. Make sure to account for all potential expenses when creating your budget. When you have the complete view, you can come up with innovative ways to cut back or eliminate certain spending areas.

Health and Care

Medicine, prescription products, hygiene products, baby needs, etc., fall under this category. Personal care is very important. However, you can still save money without having to stop taking them. There are some items that have alternatives.

Instead of buying the most expensive brand, try to look for a similar one that’s cheaper. Sometimes we feel like just because a product costs more, it is the best. Be open to trying different products when you can.

Household Products

A couple of things to remember before going to the grocery store, don’t go on an empty stomach because chances are you are going to want to grab a lot of different snacks and food. You will end up buying much more than what you planned to get. Another thing to bear in mind, make a list of things you need at home.

Having a list will help you limit the products that you will be buying. There are some instances, too, that it is better to buy in bulk. Check out the types of stores you go to. This way, you will have an idea of which store sells cheaper things but the same brand.

Utility Bills

A precise quotation from utilities that is sent and paid once per month is called a utility bill. This category includes water, electricity, heater, cable, internet, rent, gas, etc. With that being said, I think cable and internet are not as essential as the others. One thing to lessen your bills is to choose to keep either cable or internet. Some cable shows are available to watch through websites. Canceling cable might be the better option.

Subscriptions

I’m sure most people have a Netflix subscription. Some even might have all there is Disney+, Hulu, Spotify, YouTube Premium, Amazon Prime, and all those other mobile apps too. With all the great subscriptions people can get out there, people sometimes don’t realize how much amount of money goes to just these monthly fees.

Try and total all of these and see the total cost. Quick tip, be sure to know the benefits of each subscription. I think it is also safe to say that you don’t need each and every one of those movie & series plans. You wouldn’t want all your monthly income going to those, right? Choose only the ones you want and use most, then cancel the rest.

Insurance

Car insurance, life insurance, house insurance, health insurance – these are all very useful and can help you in the future. We can never tell when we are going to need car repairs. It is always a great thing to be ready. Check with your insurance company and learn more about your plans. Most people don’t know what they are paying for; knowledge is key. You might be paying more than what you need.

Business

Business expenses are regular, required fees that a company must pay in order to operate. Businesses must keep track of and classify their spending because some costs can be deducted from taxes. Taxable income is decreased by deductible expenses, which can result in significant cost savings for businesses. These expenses include but are not limited to rent, utilities, furniture, payroll, office supplies, software, and many more.

Pet

There are lots of things to consider when you have a pet. They can be quite expensive too. Food, medicines (if required), toys, grooming, and many more. As fun as it sounds, you are going to need to have a budget to own a pet.

Emergency Fund

Managing money and having enough to set aside as an emergency fund can certainly assist you to get through difficult moments. Your emergency fund would grow to $15,000 if you reserve $1,250 each month. That sum might seem overwhelming, so if you can’t fit it into your monthly cost budget, begin with a smaller amount and set aside what you can spare.

FREE PRINTABLE EXPENSE TRACKER

The best part about this free printable expense tracker is that it’s totally free for you to download. Just click on the link below, and you’ll be ready to print and use them immediately!

If you enjoyed this expense tracker post, be sure to check out these other great printables next time:

Be sure to PIN this for LATER and SHARE on FACEBOOK!